The Covid-19 crisis has dramatically transformed the expectations of individuals and businesses when it comes to banking services. But beyond PSD2 compliance, not all financial institutions have the same digital maturity and are adopting Open banking initiatives in a piecemeal fashion. To help its institutional customers take advantage of upcoming opportunities, ALTEN Group’s banking experts and Innovation Labs have identified the levers (trust, Customer eXperience – CX…) and are developing innovative PoCs (RGPD interface with Blockchain…).

Lockdown, bank branch closures… Financial institutions have seen an acceleration in the digital uses of their customers. According to a study published by deVere, the use of fintech apps and mobile banking services has surged by 72% in Europe, in just one week. Faced with an uncertain economic future, individuals and businesses alike needed a consolidated view of their financial situation, personalized advice and management services (credit, insurance…), accessible from their mobile phone. This requires greater openness of banks’ information systems and better interoperability with third-party service providers or business introducers.

Thus, the major challenge for a banking player is to be the leading platform for financial services. A bank’s profitability and growth will depend on its ability to open up its ecosystem to its partners, to offer services and an experience in line with its customers’ uses and lifestyles. By the end of 2021, more than 90% of banking institutions plan to become Open banks (Deloitte’s study).

Banks have adopted different business models to exploit the potential of Open Banking. (Open Banking Tracker Blog).

Trust and CX: a general reluctance to be removed

In Europe, Open banking is being pushed by the European regulation PSD2, the European Union’s Second Payment Services Directive. Imposed since September 2019, it compels European banks to give access to payment transaction data (account information services – AISP – and payment initiation services – PISP) to approved third-party players (banks, fintechs…). The end customer is now the owner of his banking data, and if he wishes, his bank must let other players access it.

The sector’s opinion is divided on the initiative. The banking sector is easily appropriating digital innovations (mobile application, biometric identification, 100% online account opening…), but for many institutions, the opening of banking data is perceived at best as a cost and at worst as a threat. Regulations are forcing them to completely rethink the way they access and use customer data. Banking CIOs also need to develop an infrastructure capable of supporting this open approach such as APIs (Application Programming Interface). But beyond the cost, in the era of Open Banking, banking institutions fear “disintermediation” with their customers if their digital platforms are less attractive.

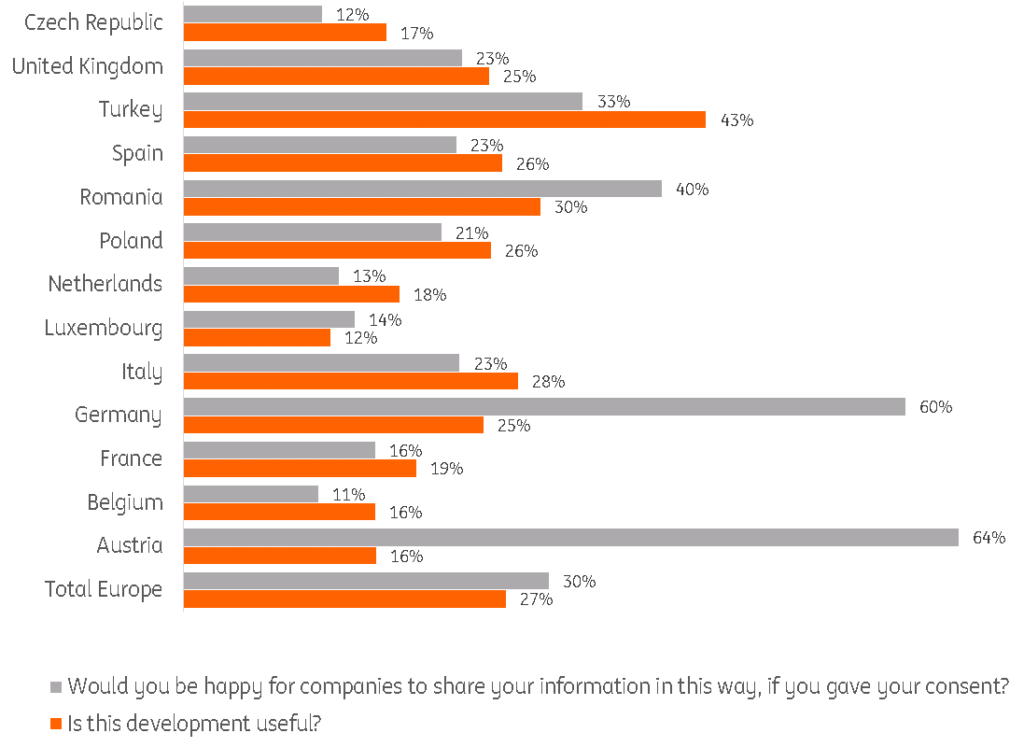

On the end-customer side, a European survey by ING shows that they are still reluctant to use open banking. According to the survey, only 30% of Europeans are willing to give their consent to allow data sharing between financial service providers. The figure drops to 16% for the French.

For the end customer, the opening of banking data raises several questions:

- What are the tangible benefits for me?

- Beyond RGPD compliance, how is personal data stored, used and secured?

- Can banks generate profit without my consent?

- Will the user experience be smooth? Will the multiplication of authentications reduce the efficiency?

If banks want to make their Open banking services take off for their customers, these obstacles must be removed. And on the internal side, a more global Open banking strategy requires both technological and cultural digital maturity.

Open banking: blockchain and AI as technological levers

To assist its banking customers with these future challenges, in March 2020 the ALTEN Group launched an R&D program dedicated to the “Open banking” theme and mobilizes several entities in Paris, Rennes and Sophia Antipolis: the business experts of the Banking, Finance & Insurance BU (design thinking), two ALTEN Labs (technological R&D, functional architecture) and ALTEN’s technical department (application development).

This R&D program enables the Group to:

- Develop an experimental technology platform (IT backend)

- Build innovation approaches in R&D and mobilize skills in blockchain / Artificial Intelligence

- Facilitate the creation of specific solutions for its customers and partners

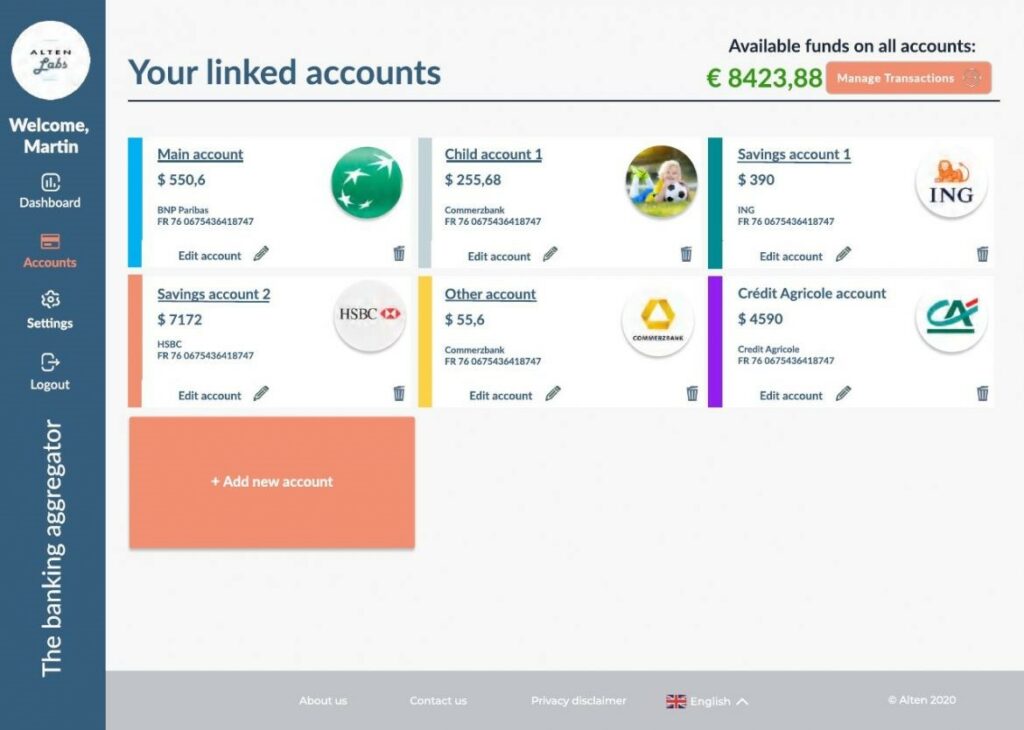

To meet the challenges mentioned above, ALTEN first developed the “foundation”, an aggregation platform (ONE.SERVICES) that complies with DSP2. It allows the various institutions in the sector (banks, fintechs, etc.) to interconnect via micro-services in a secure manner, to offer new customised customer experiences by aggregating multiple data sources.

The other cornerstone of the program is the personal data management interface (ONE.MYDATA). This is a single, intuitive, user-centric window for granting or withdrawing consents at any time and keeping control of one’s data in complete security. The consents and data portability imposed by the RGPD are supported by the PIMS personal information management system.

The use of blockchain technology eliminates the possibility of falsification of the setting by a malicious actor. It will thus avoid potential disputes between the customer and his bank over the agreements given.

At the same time, ALTEN is developing other prototype applications designed to provide tangible benefits to end customers.

Examples of Open Banking use cases imagined and developed by the ALTEN Group to address this customer experience issue:

- ONE.PATRIMOINE: an intelligent cobot to support private bank advisors.

The application will provide a complete dashboard of the customer’s asset portfolio, aggregating data from his various accounts and savings accounts (PEA, life insurance, etc.).

This real-time asset tracking will help build customer loyalty and help advisors better serve their clients in the management of their financial assets. - ONE.GEOASSUR’TOUT: Life companion for insurance.

This dynamic ATAWADAC (Any Time, AnyWhere, Any Device, Any Content) insurance follows the user anytime and anywhere to simplify his life. Here, the banking aggregator is used to track large purchases and automatically notify the consumer of the need to scan the bill for future insurance needs. - ONE.PHYGIPAY: Secure Phygital payment between individuals.

A true tool of the future between private individuals, this phygital payment solution allows a secure and intuitive transaction (based on a QR Code system on a cell phone) between private individuals for high-value goods: cars, watches, jewelry, etc. - ONE.CAGNOTTE: Online Kitty 3.0 for retail banking.

This is a new type of kitty integrating the latest technologies such as blockchain for a better level of trust, traceability and security.

You need assistance for a banking project? Contact us!